Content

- F. Anti-Money Laundering Program

- The Multi-Level Introducing Broker Management Portal

- B. SRO Membership (Section 15(b)( and Rule 15b9-

- FP Markets Launches the Upgraded and Redesigned Introducing Broker (IB) Portal

- Intro to IBKR Tools

- Section 103.123(b)( (ii)(C) Customer Verification—Additional Verification for Certain Customers

- Reports for Compliance Officers

- The Forex Marketing “World Cup” Region

Nor does the final rule alter an FCM’s or IB’s ability to use an agent to perform services on its behalf. Although there were no comments on this aspect of the proposed rule, commenters on the other Federal functional regulators’ proposed CIP rulemakings raised a number of concerns regarding this provision. Some commenters were concerned about how a financial institution would be able to determine what lists should be checked and how these lists would be made available. Other commenters suggested that all such lists be consolidated or provided through a designated government agency, such as FinCEN, that would serve as a clearinghouse.

On April 28, 2004, the SEC voted unanimously to change the net capital rule which applies to broker-dealers, thus allowing those with “tentative net capital” of more than $5 billion to increase their leverage ratios. As an additional feature, the ACT Risk Management process calculates the totals of compared locked-in trades for each correspondent. This figure will be related to a “Super Cap” total, which is twice the assigned threshold but never less than $1 million. Manage your investments and analyze your portfolio with a variety of tools by requesting integration with numerous third-party portfolio management software providers. Consolidate statement and activity data from multiple accounts into a single statement.

This commenter argued that the definition was overly broad and suggested that a risk-based approach be adopted instead. Since ACT accelerates the comparison cycle and creates locked-in trades, clearing firms gain extensive risk management capabilities to monitor the activities of their correspondents. The NASD also offers access to the ACT Service Desk for firms executing an average of five or fewer trades per day. IBKR’s OMS delivers incredible value for institutions looking for a best-in-class order management system.

F. Anti-Money Laundering Program

Rather, it means only that the FCM’s or IB’s relationship with the foreign firm will be treated the same as if the firm contractually delegated the implementation and operation of its CIP procedures to a service provider. The proposed rule would have required FCMs and IBs to obtain residence and mailing addresses for a natural person, or principal place of business and mailing addresses for a person other than a natural person. Treasury and the CFTC believe that the revisions made to the definition of “customer” in the proposed rule address the suggestion by one commenter that a risk-based approach be taken to determining who is a customer whose identity must be verified. This reliance provision of the final rule does not affect the ability of an FCM or IB to contractually delegate the implementation and operation of its CIP procedures to a service provider.

Find third-party, institutional-caliber research providers and access research directly through Trader Workstation . Advertise your services at no cost and reach individual and institutional users worldwide. Charge markups to clients based on IBKR stock borrow rates, entered as a variable or fixed percentage of our borrow rate. You can enter both types introducing broker of markups and our system will apply the markup rate that results in the larger total amount. Meet your compliance obligations by notifying your clients of advisory fee details. Set up enhanced user access and account security by creating one or more Security Officers for the master account and designate up to 250 users by function or account.

The Multi-Level Introducing Broker Management Portal

Account means a formal relationship with a futures commission merchant, including, but not limited to, those established to effect transactions in contracts of sale of a commodity for future delivery, options on any contract of sale of a commodity for future delivery, or options on a commodity. The final rule contains additional guidance regarding what constitutes adequate notice and the timing of the notice requirement. The final rule provides that notice is adequate if the FCM or IB describes the identification requirements of the final rule and provides notice in a manner reasonably designed to ensure that a customer is able to view the notice, or is otherwise given notice, before opening an account. The final rule also provides that, depending on how an account is opened, an FCM or IB may post a notice in the lobby or on its website, include the notice on its account applications, or use any other form of oral or written notice. In addition, the final rule includes sample language that, if appropriate, will be deemed adequate notice to an FCM’s or IB’s customers when provided in accordance with the requirements of the final rule. Walsh Continental Trader is the our newest platform offering enabling self-directed traders from across the globe to trade the markets of their choice.

- It is common for both of the exemption provisions in paragraph of Rule 15c3-3 to apply to the business activities of an introducing broker dealer.

- Access account details including working orders, filled orders, account balance, open trade equity for futures, unrealized profit/loss for options on futures, collateral on deposit, and more.

- 9 Exemptions from the requirements of Exchange Act Rules 15g-2 through 15g-6 are provided for non-recommended transactions, broker-dealers doing a minimal business in penny stocks, trades with institutional investors, and private placements.

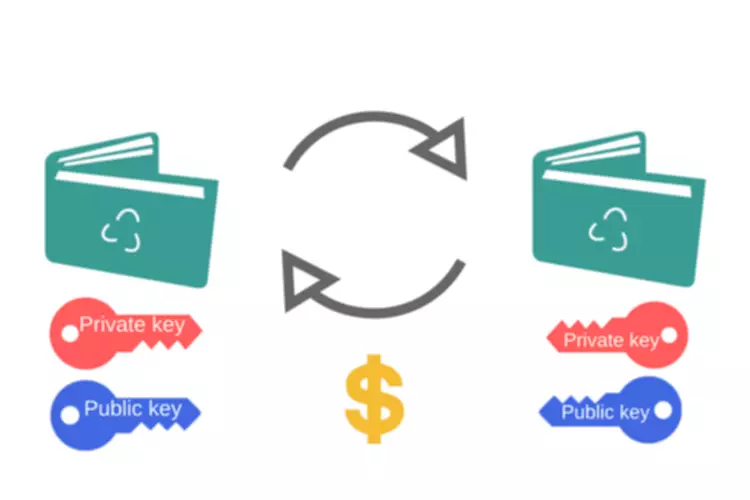

- An introducing broker is a broker in the futures markets who has a direct relationship with a client, but delegates the work of the floor operation and trade execution to another futures merchant, typically a futures commission merchant .

- Rebate calculations are performed by the platform and reports show deposits, net deposits, withdrawals, revenues, IB revenue share.

This rule thus prevents a broker-dealer from using customer funds to finance its business. By statute, thrifts have the same status as banks, and may avail themselves of the same targeted exceptions and exemptions from broker-dealer registration as banks. As such, subsidiaries and affiliates of thrifts that engage in broker-dealer activities are required to register as broker-dealers under the Act. Firms that limit their securities business to buying and selling municipal securities for their own account must register as general-purpose broker-dealers.

B. SRO Membership (Section 15(b)( and Rule 15b9-

Formal guidance may be sought through a written inquiry that is consistent with the SEC’s guidelines for no-action, interpretive, and exemptive requests. The integration with MT4 allows the business to automatically open an MT4 account after registration, withdraw the balance and handle transactions in MT4. The Investors’ Marketplace lets individual traders and investors, institutions and third-party service providers meet and do business together. Our statements and reports cover real-time trade confirmations, margin details, transaction cost analysis, sophisticated portfolio analysis, tax optimization and more. Understand risk vs. returns with real-time market risk management and monitoring that provides a comprehensive measure of risk exposure across multiple asset classes around the world.

There were no comments directly addressing the documentary verification provisions of the proposed rule, and the final rule adopts the documentary verification provisions substantially as proposed. Specifically, the final rule requires an FCM’s or IB’s CIP to contain procedures that set forth the documents that the firm will use to verify a customer’s identity. Each FCM or IB will conduct its own risk-based https://xcritical.com/ analysis of the types of documents that it believes will enable it to verify the true identities of its customers. Before it begins doing business, a broker-dealer must become a member of an SRO. If a broker-dealer restricts its transactions to the national securities exchanges of which it is a member and meets certain other conditions, it may be required only to be a member of those exchanges.

FP Markets Launches the Upgraded and Redesigned Introducing Broker (IB) Portal

The final rule has been re-organized to be structurally consistent with the rules being issued by Treasury and the other Federal functional regulators. Thus, requirements that had been set forth in paragraphs through in the proposed rule are now contained in paragraphs through of the final rule to the extent they have been adopted. The rule’s structure was changed in order to affirm the intent of Treasury and the Federal functional regulators that all the CIP rules impose the same requirements. Two commenters addressed the proposed rule’s identity verification requirement. One commenter supported the proposed rule’s framework for when verification would be required of existing customers that open new accounts.

In all other respects, the records must be maintained pursuant to the provisions of 17 CFR 1.31. When the futures commission merchant or introducing broker should file a Suspicious Activity Report in accordance with applicable law and regulation. Futures commission merchant means any person registered or required to be registered as a futures commission merchant with the Commission under the Commodity Exchange Act (7 U.S.C. 1 et seq.), except persons who register pursuant to Section 4f of the Commodity Exchange Act (7 U.S.C. 6f). Once an FCM or IB verifies the identity of a customer through a document, such as a driver’s license or passport, it is not required to take steps to determine whether the document has been validly issued. An FCM or IB generally may rely on government-issued identification as verification of a customer’s identity; however, if a document shows obvious indications of fraud, the FCM or IB must consider that in determining whether it can form a reasonable belief that it knows the customer’s true identity. Under these definitions, an FCM or IB will not necessarily need to establish whether a potential customer is a U.S. citizen.

Intro to IBKR Tools

The appropriate SRO generally inspects newly-registered broker-dealers for compliance with applicable financial responsibility rules within six months of registration, and for compliance with all other regulatory requirements within twelve months of registration. A broker-dealer must permit the SEC to inspect its books and records at any reasonable time. Broker-dealers that are exchange specialists or Nasdaq market makers must comply with particular rules regarding publishing quotes and handling customer orders. These two types of broker-dealers have special functions in the securities markets, particularly because they trade for their own accounts while also handling orders for customers.

Generally, this will be the person who fills out the account opening paperwork and provides the information necessary to open the account in the name of the minor or group. This commenter suggested that notice should not be required of FCMs and IBs, and that if it is required, posting a notice on the firm’s Internet website should be deemed sufficient for all customers. The documents posted on this site are XML renditions of published Federal Register documents. Each document posted on the site includes a link to the corresponding official PDF file on govinfo.gov.

To pitch this idea, they prepared a presentation, justified everything correctly, made a plan and an assessment. We have been working with Ardas for more than 5 years, we started with a part-time team that developed our and still maintains it, plus does all the work on our website, which is the only source of all customers. The website supports 6 languages, does all the integrations with all systems that we use . “I have been working as a CTO for 6 years and for all this time Ardas has always been very responsible and attentive to all the nuances and peculiarities of our business. We do not feel any barriers, neither linguistic nor distance. The platform was developed as a worldwide system and today also focused on China market. We support 53 payment systems including China UnionPay, Skrill, Neteller, AstroPay, Mercury, EasyEFT, EcoPayz, Finrax, MiFinity, OctaPay, PayCent, PayGuru, Payment Asia, TradersCoin, Volt, Zota, Xentum, UniversePay, etc.

Section 103.123(b)( (ii)(C) Customer Verification—Additional Verification for Certain Customers

Under the final rule, FCMs and IBs still must make a record of all identifying information obtained about each customer. With respect to non-documentary verification, the final rule requires the records to include a description of the non-documentary methods and the results of any additional measures undertaken to verify the identity of the customer. The final rule also requires a description of the resolution of any “substantive discrepancy” discovered when verifying the identifying information obtained. This is intended to make clear that a record would not have to be made in the case of a minor discrepancy, such as one that might be caused by typographical mistakes. The proposed rule included an exception from the requirement to obtain a TIN from a customer opening a new account.

A person other than an individual that is established or organized under the laws of a State or the United States. Option means an agreement, contract or transaction described in Section 1a of the Commodity Exchange Act (7 U.S.C. 1a). Contract of sale means any sale, agreement of sale or agreement to sell as described in Section 1a of the Commodity Exchange Act (7 U.S.C. 1a). Commodity means any good, article, service, right, or interest described in Section 1a of the Commodity Exchange Act (7 U.S.C. 1a).

With an average industry experience of 25 years, our professionals specialize in all aspects of the markets so that we can service all of our client’s needs. In addition to our daily commentaries we are pleased to provide the following special reports. Although many broker-dealers are “independent” firms solely involved in broker-dealer services, many others are business units or subsidiaries of commercial banks, investment banks or investment companies. Essentially, if a broker-dealer has any potential to receive customer funds , it should establish a special account. The account must be maintained for the benefit of customers and can’t be subject to any lien, creditor, etc. If a broker-dealer doesn’t have a special account but subsequently determines it’s necessary, e.g., it receives a check, the issue can be corrected and listed as an exception in the exemption report.

Finally, on November 26, 1990, over-the-counter transactions in listed stocks began being compared through ACT. Our optimized reporting systems efficiently batch and process large reports and notify you once processing starts. Statements can be downloaded in a variety of formats, including text, PDF, CSV or HTML, for use with third-party tools like Quicken, Tradelog or CapTools. Get a snapshot of client revenues, net revenue, gross margin and aggregate client mark-to-market.

The IBKR Compliance team will provide reports to help you ensure your business and operations remain in compliance with applicable regulations. Track your trading activity, including intraday trade confirmations, or create customized reporting templates for monitoring trade detail. PortfolioAnalyst, our free tool for linking investment, banking, checking, incentive plan and credit card accounts into a complete portfolio view to calculate returns, understand risks and measure performance against benchmarks. With the new and updated IB portal, IBs have access to view their clients’ traded volumes and Sub-IB networks, and the ability to produce bespoke reports using advanced analytics tools. Partners can closely follow the client journey from approval status to deposits and withdrawals, ensuring full transparency. 12 When a broker-dealer is a member of more than one SRO, the SEC designates the SRO responsible for examining such broker-dealer for compliance with financial responsibility rules (the “designated examining authority”).

The Forex Marketing “World Cup” Region

Treasury and the CFTC believe that these changes either clarify or liberalize the scope of the proposed rule with respect to FCMs and IBs. Taxpayer identification number is defined by section 6109 of the Internal Revenue Code of 1986 (26 U.S.C. 6109) and the Internal Revenue Service regulations implementing that section (e.g., social security number or employer identification number). This table of contents is a navigational tool, processed from the headings within the legal text of Federal Register documents. This repetition of headings to form internal navigation links has no substantive legal effect.